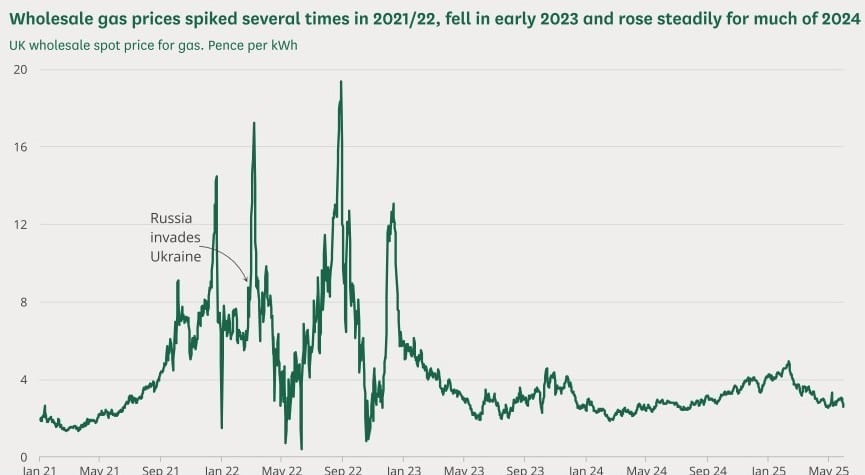

The energy crisis in the UK spiked in 2022 when a decrease in Russian supply sent shockwaves across the European markets. What’s more, the global demand for energy after the lockdowns hiked prices before the war between Russia and Ukraine began.

The landscape of energy prices has been volatile in the UK ever since. Wholesale energy costs dropped in February, but they’re set to rise again as the winter months approach in October 2025.

Households can somewhat rely on an energy price cap to keep costs at a manageable rate, but there is no government-backed system in place for businesses.

This means that UK-based businesses are facing soaring energy prices, and that is particularly true for Daniel, who owns Zuma Rock Restaurant & Bar. He recently took out a business loan to manage his cash flow as the cost of energy was draining his finances.

How Did the Business Start?

Daniel founded Zuma Rock in 2023 with his wife. After saving for many years, they bought a commercial property to renovate and open their own bar and restaurant that specialises in African cuisine.

The UK was recovering from the energy crisis in 2022 when Daniel started his Kettering-based restaurant. Prices were gradually decreasing, and it seemed like a less volatile environment to begin a new business venture.

Source: nationalgrid.com Prevailing View tool (system average price)

Why Did Zuma Rock Get a Business Loan?

Daniel applied for a business loan to ease Zuma Rock’s cash flow. The extortionate cost of energy to run a restaurant was having a devastating impact on their day-to-day operation. Their issues can be pinpointed to two main factors.

No Government Support

Zuma Rock is one of the many SMEs across the country that is suffering because there is not an energy price cap for businesses. There is only a price cap for domestic households.

The energy price cap is a limit set by Ofgem that suppliers can charge per unit of gas and electricity. It prevents suppliers from overcharging so households can keep up with potential increases in prices.

Business owners are not protected in the same way. Every company uses energy to vastly different degrees and amounts, so it’s difficult for the government to provide a singular limit that applies to all corporations.

Nonetheless, there was a scheme that ran from October 2022 to March 2024 called The Energy Price Guarantee that supported businesses during the height of the energy crisis in the UK. It limited the cost per unit of energy from suppliers so SMEs could survive the price hikes that were occurring.

The scheme ended last year when energy prices began to deflate, but many SMEs had become reliant on the price cap to afford their running costs. What’s more, energy is still vastly more expensive than pre-pandemic levels, so businesses are left to deal with higher prices with no support.

Restaurants Are Energy Intense

Zuma Rock is one of the many businesses that are adjusting to this change. Additionally, of all commercial buildings, restaurants use the highest amount of energy per square metre, so they will be hit the hardest with increased bills.

Daniel explained that the biggest drivers of energy costs in his business include:

Cooking

Equipment like ovens, grills, and hobs use a lot of electricity over long hours.

Refrigerators

Keeping food chilled and frozen is essential to avoiding bacteria but can hike energy costs.

Hot Water

Constant use of running taps and dishwashers requires the use of boilers and water heaters.

Ventilation

Ventilators need to be used to extract smoke, steam, and heat from kitchen areas.

Lighting

Bright lighting is required in the kitchen as well as comfortable lighting in the dining area. Together, these strain electricity resources.

Zuma Rock is just one of the many restaurants across the UK that are feeling the pinch of energy cost hikes. Their entire industry is bound by constant use of heat, cooling, and lighting resources to trade.

How Has a Business Loan Helped Zuma Rock?

The aftermath of the energy crisis in the UK has had a huge financial impact on Zuma Rock. With higher bills to pay, the company’s cash flow has become more strained than ever.

Daniel sought commercial finance to help with the issue.

Boosted Cash Flow

He got in touch with Crispcap for a cash flow loan to inject some working capital into the business.

Daniel told us that the result has been fantastic. After getting funded quickly and stress-free, he’s been able to make crucial payments for the business much more easily.

These mostly include stock and equipment purchases to keep the restaurant thriving. He’s also using the cash injection to cover the costs of recruiting and training new members of staff.

Loan term

Daniel opted for a cash flow loan of £2,000 over a monthly repayment term of 6 months.

For him, this influx of money will allow his business to keep moving when energy prices unpredictably spike. It’s a safety net to manage the volatile conditions of the market.

The 6-month term is a manageable repayment plan that doesn’t jeopardise the smooth running of the company. The monthly instalments allow for better financial planning and, ultimately, growth.

Daniel has said he will be returning to Crispcap after the term is finished for a higher loan amount.

What’s Next for Zuma Rock Since the Energy Crisis in the UK?

With a business loan, Daniel has found a reliable system for keeping up with energy payments and preserving his cash flow. Now he’s looking at new ways to grow the business with commercial finance.

The business owner has a plan to invest in creative marketing opportunities. Website and radio advertisements have caught his interest, and he looks forward to testing different strategies that could increase restaurant bookings.

At Crispcap, we’ve worked with countless businesses to raise finance for their marketing strategies and website builds. We look forward to supporting Daniel more soon.

Final Thoughts

It’s clear that some businesses are still struggling with energy prices in 2025. Whilst household energy caps are widely reported on, there has been little support for businesses since the Energy Price Guarantee ended last year.

Daniel’s business, Zuba Rock, is an example of how SMEs are seeking ways to protect their cash flow amongst this uncertainty. A business loan can be a much-needed source of backup finance if bills constantly fluctuate.

If the government can’t produce a scheme for controlling commercial energy prices, business finance can be a helpful way to manage unpredictable costs.

You can apply for an unsecured business loan in less than 30 seconds without affecting your credit score. A member of our team will be in touch shortly after to explore your finance options.