How Does a Merchant Cash Advance Work?

A Merchant Cash Advance is a business loan that is repaid to the lender through your sales on card. It’s simple – you get a lump sum of funds, and then a percentage of your future earnings is sent to the lender until the loan is paid off. A straight-forward and effortless process for businesses that earn through card payments, whether online or face-to-face.

Great for…

The Benefits

How Much Does a Merchant Cash Advance Cost?

The interest rate on a Merchant Cash Advance depends on several factors, and the volume of card sales will impact your loan options. Generally, the higher your turnover, the lower the interest rate on your business loan. Your credit rating, homeowner status, and the length of time your business has been running will also affect the interest rate. Our lenders work on a risk basis and favour businesses that are more likely to repay under the agreed terms.

Business Loan Calculator

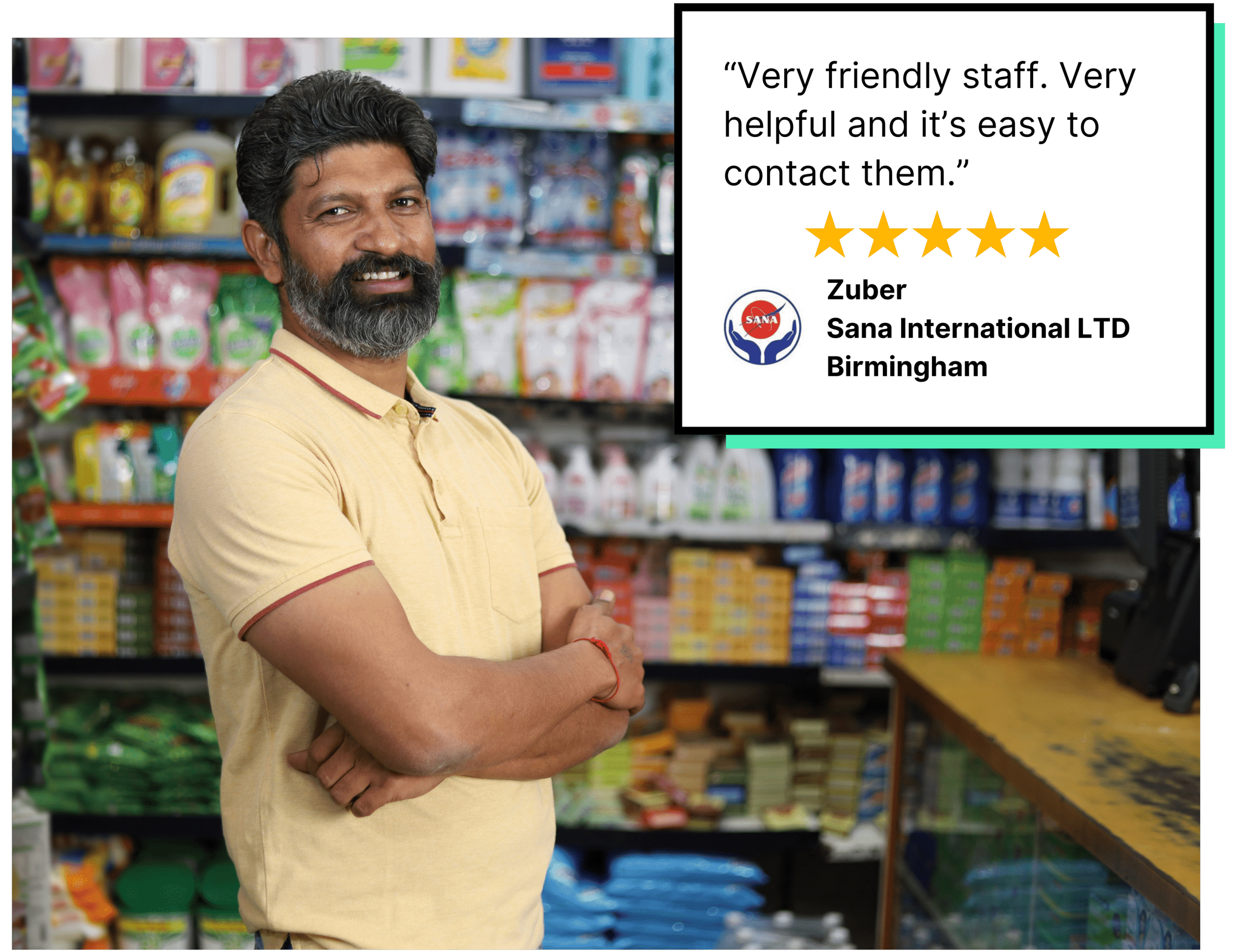

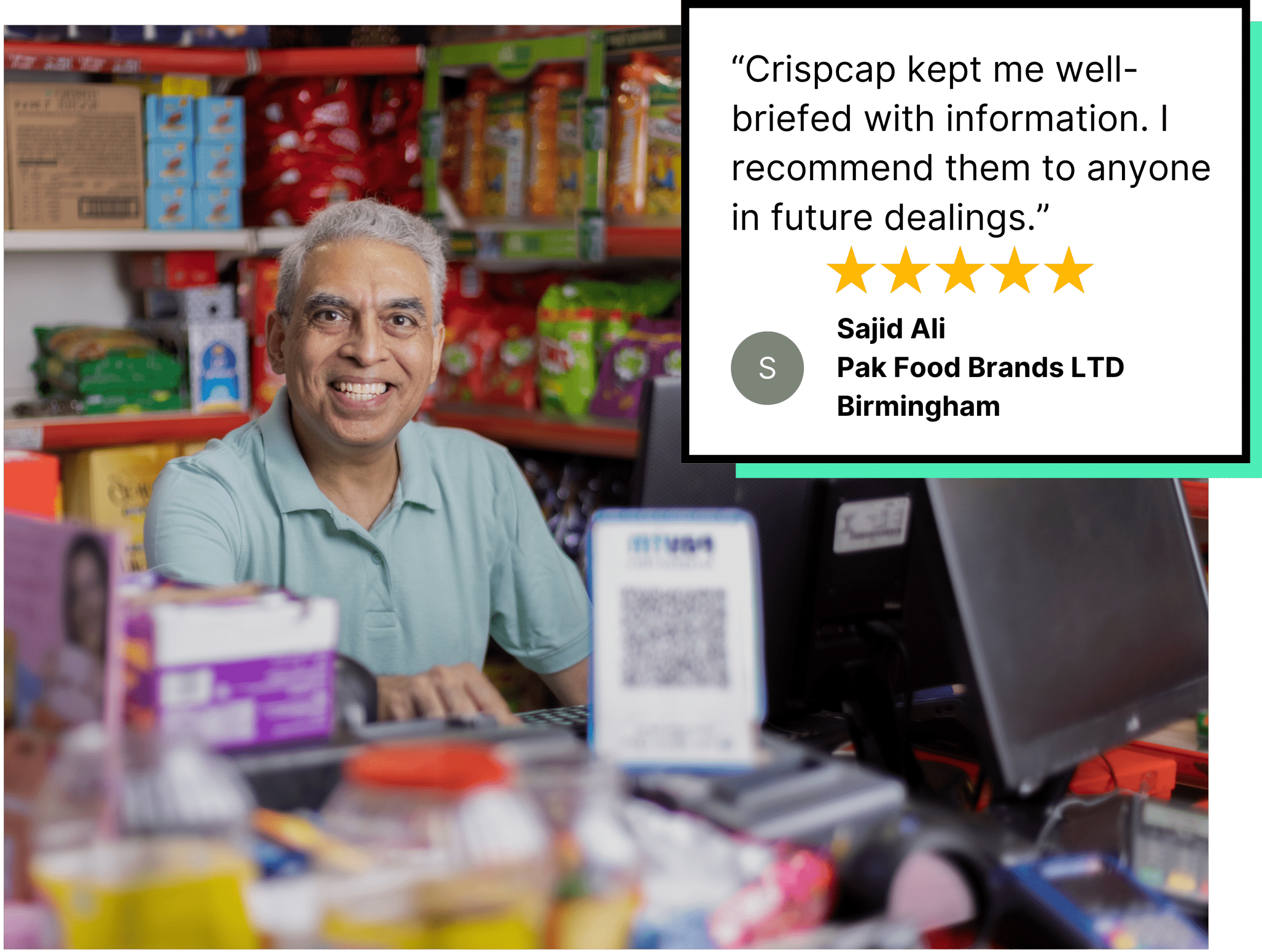

Crispcap Is Here To Help

Crispcap has been supporting business owners with merchant cash advances for years. We’re a finance brokerage that works tirelessly to place businesses with lenders that can meet their desired loan term and amount. In our experience, a merchant cash advance is the most accessible and manageable finance option on the market. That’s why we’re passionate about helping businesses fulfil their potential with the right funding for them.

Read the stories of the small businesses we’ve supported in our case studies.

What Can I Use a Merchant Cash Advance For?

A Merchant Cash Advance is a business financing option that can unlock huge benefits.

Stock

Bulk buy stock to get access to lower prices and a higher profit margin.

Everyday Costs

Successfully maintain the running costs of your business.

VAT Bill

Avoid fines and penalties from HMRC by paying your tax bill on time.

Marketing

Fund paid ads for your business and reach more customers.

Equipment

Get the tools you need to get the job done, whatever industry you’re in.

Wages

Retain your staff by paying them on time.

New Opportunities

Have the funding to support a higher workload.

Refurbishment

Give your business premises a fresher look to attract customers.

Have Questions About a Merchant Cash Advance?

What is a Merchant Cash Advance?

They are a form of business loan. You get an injection of cash and pay the loan off with your future earnings on card terminals. With every transaction, you pay back a percentage to the lender.

How Do I Get a Merchant Cash Advance?

If your business uses a card terminal for payments, you may be eligible for a loan. Simply fill in your details here with our 30-second application, and we’ll walk you through your finance options.

Are Merchant Cash Advances a Good Idea?

They are a great option for businesses that use card terminals for payments and want to strengthen their cash flow. You get a lump sum of funding, and you only repay when your business is earning money; it’s the most stress-free repayment method.

Can I Get a Merchant Cash Advance?

If you take most of your payments via card, you could be eligible for a merchant cash advance. Some other factors to consider is your business health, turnover, credit rating, and business health. Apply for a business loan here to start your funding journey.

What if I Have Bad Credit?

At Crispcap, we work with businesses of various credit ratings. Unlike traditional lenders, we look at other aspects of your business to determine your eligibility. Your business’s health is the most important aspect to consider.

What Loan Amount Can I Get?

At Crispcap, we utilise our financial network to try and secure the business loan amount that you’re looking for. Each business can access different amounts of funding..

Our Funding Process

1. Get In Touch

Confirm what loan amount and term you’re looking for in just 30 seconds.

2. Send Your Documents

We only need your last 6 months of business bank statements and last set of full filed accounts.

3. Application Approved

We’ll review your documents and get your funding request approved with one of our specialist lenders.

4. Funds Are Transferred

The money will be in your bank account shortly after approval. Sometimes in as little as 4 hours.

Our Funding Process

1. Get In Touch

Confirm what loan amount and term you’re looking for in just 30 seconds.

2. Send Your Documents

We only need your last 6 months of business bank statements and last set of full filed accounts.

3. Application Approved

We’ll review your documents and get your funding request approved with one of our specialist lenders.

4. Funds Are Transferred

The money will be in your bank account shortly after approval. Sometimes in as little as 4 hours.