Crispcap has a panel of fast business loan lenders that thousands of SMEs (small to medium-sized businesses) have used for funding. For Muhammad, the owner of Azoom, a business loan was the solution to his troubles with wholesale stock.

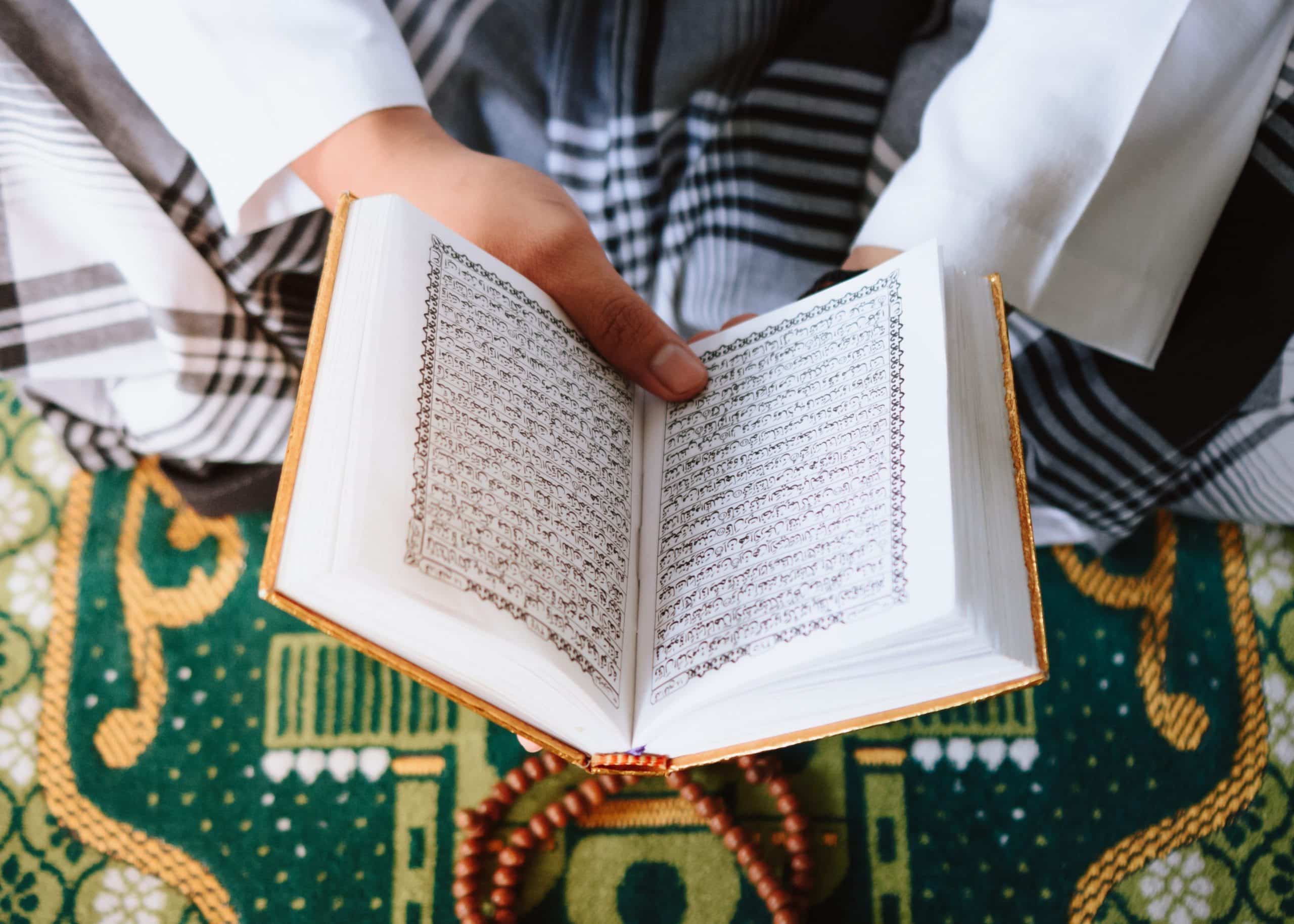

Among his different companies, Azoom sells educational resources that teach people about the Islamic religion and culture. He sells books, stationery, and children’s toys on different online platforms.

Nevertheless, Muhammad needed funding to expand his stock line and get cheaper rates by purchasing in bulk. Crispcap’s lenders arranged him £7,500 over a repayment term of 6 months.

1. How Did Azoom Start?

Azoom started as a business venture from home. Muhammad’s passion for his religion combined with his deep value of education evolved into an exciting and prosperous business.

Among his best-selling items are books and translations of the Quran, with many children’s books proving popular too. These are mostly accessible guides to help young people transition into the responsibilities that come with the Islamic faith.

Muhammad’s business has rapidly become a profitable operation that supports people in his religious community and beyond. But to expand Azoom’s reach even further, he knew he had to investigate finance options that would facilitate more growth.

2. What Challenges Did They Have Before Getting a Business Loan?

Muhammad knew he could save more money on stock if he could buy in bulk.

This is one of the most frequently used tactics by small businesses across the globe. Studies show that SMEs that centralise spend, and leverage scale can achieve 10-15% cost savings.

Muhammad stated that even a “1%” saving in stock prices could make a huge difference to his operation. There was (and still is) a demand for his service, he just needed to supply buyers through the cheapest means possible.

Whilst bulk buying stock is a simple tactic to employ, business owners need considerable funds to get the process in motion. Among the many benefits of a business loan, this is one of their most frequent uses.

Muhammad filled in an online application with Crispcap to detail his funding requirement. He wanted to utilise our panel of fast business loan lenders to get finance for more stock at a cheaper price. We were thrilled at the prospect of scaling his business’s growth.

3. How Have Our Fast Business Loan Lenders Helped Azoom?

He’ll use the funds to buy a higher volume of stock at a cheaper rate. This means he can manage more orders across all his online stores on eBay, Amazon, Etsy, Instagram, and Facebook.

The funding has allowed him to save money on bulk buying and plan his growth for the future. This means he can streamline the ordering process for less invoices and paperwork. What’s more, his operation will benefit from consistently high stock levels as customer satisfaction will be increased.

Muhammad’s short term loan also sped up the funding process for a quick injection of working capital. He’ll be making monthly repayments at a lower interest rate than a long term loan.

His vision for Azoom has become a reality as the company is sustainably turning high profit while helping young people learn about the Islamic faith.

4. What’s Next For Azoom?

Muhammad has a few businesses, but Azoom is his main source of income. He sees it as a scalable operation that he can grow for years to come.

For him, that means buying more stock, offering more products on his online store, and cutting costs where he can. Ultimately, the more stock he buys, the more he’ll save and be prepared for future orders.

The short term loan was a great strategy to kick-start this long term goal. Next, he plans on utilising our fast business loan lenders again for a higher loan amount for a bigger stock purchase. Now that he’s established a successful business model, this is the beginning of his journey to more success with Azoom.

Can I Use Crispcap’s Fast Business Loan Lenders?

Crispcap’s panel of lenders work with businesses of all sizes and arrange funding to supercharge their growth. You can apply for a business loan in 30 seconds here without affecting your credit score.